To maintain a competitive edge and ensure sustain long-term relevance, Indonesian insurance companies have a clear mandate to move beyond outdated, paper-based workflows. The future of risk management isn't just digital; it's profoundly intelligent. It is about harnessing the power of Artificial Intelligence (AI) to transform the entire claims process from a reactive, cost-center expense into a proactive, data-driven defense mechanism.

Navigating the Complexities of the Modern Indonesian Market

The landscape in Indonesia presents a unique and demanding set of challenges. While digital adoption has rapidly accelerated in banking and e-commerce, the insurance sector often lags, leaving companies vulnerable to inefficient legacy systems.

The fraud environment is particularly nuanced. A 2024 FICO survey noted that a striking 77% of Indonesians consider falsifying an insurance claim the most "taboo" form of financial fraud. However, the fraud reality is complex, often involving opportunistic or small-scale incidents that accumulate into significant losses. Simultaneously, rising claims costs are continually outpacing the Consumer Price Index (CPI), driven by inflation in medical care, repair parts, and labor. This creates immense and unsustainable pressure on profitability and loss ratios.

These compounded pressures, worsened by manual and lengthy processes, lead to customer dissatisfaction. When customers already feel let down, with a third of individuals blaming financial institutions for scam-related losses, here is a clear and urgent demand for insurance companies to step up. They must act as a reliable "shield" that proactively prevents fraud and mitigating risk, rather than simply processing losses after the damage is done.

The Three Major Pain Points Demanding Immediate AI Adoption

The reliance on legacy systems and slow processes creates three key business pain points that directly impact an insurance company's financial health and ability to retain loyal customers:

- High and Rising Operational Costs

Traditional manual claims handling is intrinsically labor-intensive and time-consuming. From dispatching human adjusters for physical inspections to tedious manual data entry, these processes are inherently inefficient. For complex cases like health or property claims, manual review multiplies errors and dramatically extends cycle times, consuming immense human capital and eroding profits that could be reinvested in growth. - Significant Financial Leakage from Fraud

Fraudulent and abusive claims are a continuous and silent drain on the industry, costing billions globally every year. This financial "leakage" directly impacts every policyholder through higher premiums. The core strategic challenge is how to prevent insurance fraud with a high degree of precision—detecting sophisticated schemes and patterns—without simultaneously creating friction that frustrates and alienates the remaining 99 % who are honest policyholders. - Critical Erosion of Customer Trust and Loyalty

Slow, frustrating, and opaque claims experiences are the primary drivers of customer churn. When a claim takes weeks instead of minutes, the brand promise is broken. This poor experience directly threatens an insurance company's ability to retain clients and build the trusted reputation necessary for long-term success in a highly competitive digital economy.

Transforming Claims End-to-End with commsult

The AI Solution that Transforming Claims from End-to-End

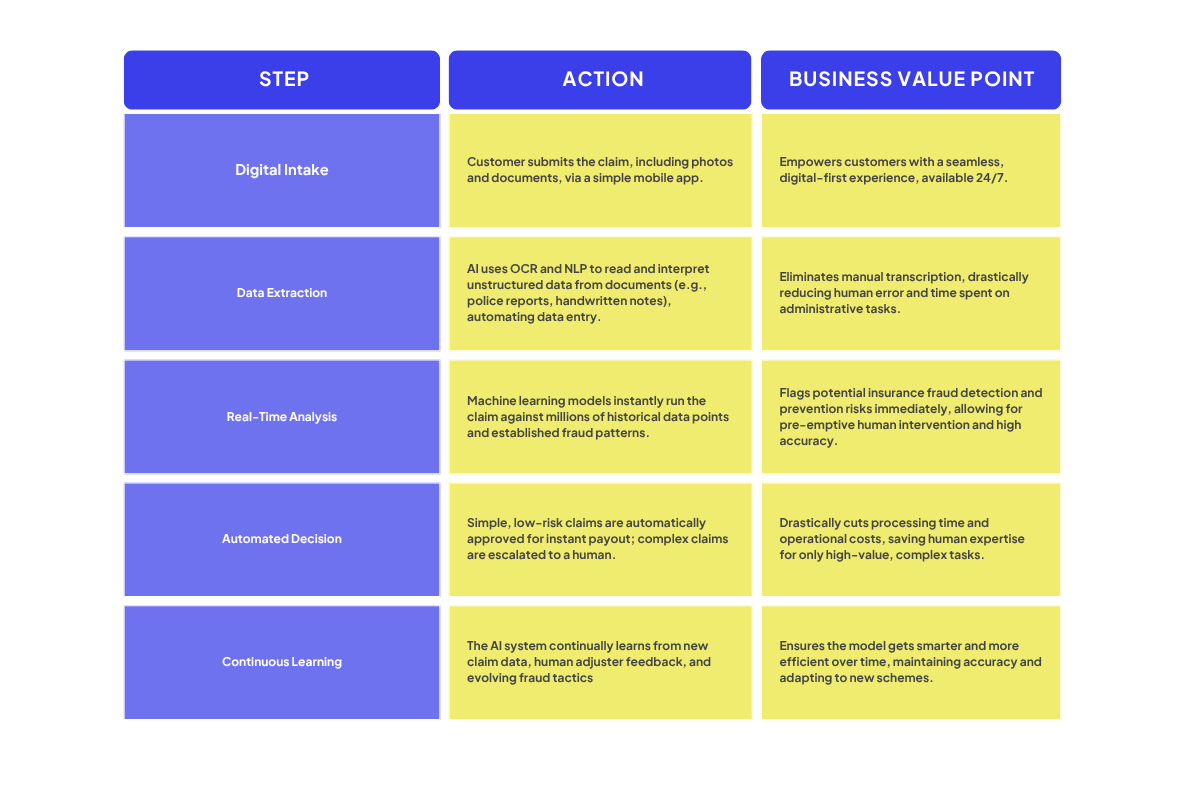

The traditional model’s inefficiency is no longer viable. The industry requires a fundamental transformation, and Artificial intelligence in insurance is the key. AI is not simply a patch; it represents the next evolution for AI powered fraud detection and comprehensive claims management, enabling insurance companies to move from a manual, reactive paradigm to a proactive, data-driven, and hyper-efficient one. This comprehensive digital transformation insurance is the future of insurance.

AI fundamentally rewires the entire claims process. It begins with empowering the customer through a digital self-service platform. This immediate digital intake shifts the adjuster’s role from administrative data entry to high-value validation and customer support, leveraging cutting-edge technology to deliver a faster, smarter, and more transparent experience. This level of digitalization in the insurance industry positions the company as a true Insurtech leader. The machine learning in insurance industry is what makes this transformation possible. This process is the definitive insurance fraud solution.

Key Technology Behind Claims Automation

Behind every powerful Insurance for AI driven claims system are three core technological components working in concert:

- Computer Vision for Image Analysis

This technology allows a computer to "see" and interpret uploaded images with human-level accuracy. In motor vehicle claims, for example, car insurance AI utilizes advanced image analysis AI (sometimes leveraging features akin to openai image analysis) to interpret uploaded photos. This ai picture analysis doesn't just recognize a dented fender; it identifies the model and year of the vehicle, verifies it against policy details, estimates the cost of the repair part, and compares the claimed damage against the reported accident scenario. This fully automated damage assessment is the core of claims automation ai, eliminating the need for slow, manual field inspections, and streamlining the claims process entirely. - Machine Learning (ML) for Risk Scoring

Machine learning in claims processing is the predictive engine that learns from complex features hidden within the data. Models are trained on thousands of past machine learning insurance claims to understand not just what a "normal" claim looks like, but what combination of features—such as time of day, proximity to a repair shop, or high-frequency claim clustering—constitutes elevated risk. By identifying subtle inconsistencies that human investigators might miss, ML is crucial for claim prediction machine learning and identifying the likelihood of a claim being staged, organized, or fraudulent. - Real-Time Anomaly Detection

This is the system’s immediate "real-time anomaly detection" red flag mechanism. It instantly compares a new claim against millions of data points to spot deviations from the norm the moment the claim is filed. This helps flag highly suspicious activity in real-time, allowing the insurance company to address potential fraud before funds are disbursed. Examples include detecting claims filed from geographically unusual locations, identifying "ghost policyholders," or spotting sudden spikes in claims frequency following a policy modification.

Build Smarter Claims Technology with commsult

The Tangible Business Value and ROI

The implementation of an AI-powered workflow delivers measurable results that directly address all of an insurance company’s most pressing operational challenges. This insurance industry digital transformation is critical for long-term health:

- Dramatic Cost Reduction

Automation in tasks like data ingestion, triage, and simple approval allows insurance companies to reallocate staff, leading to a 30% to 50% reduction in operational costs and up to a 65% reduction in claims processing costs. This directly helps reduce insurance costs, and the return on investment (ROI) is often swift, driven by immediate efficiency gains. - Unprecedented Fraud Detection

AI systems are capable of analyzing vast, interconnected datasets that are impossible for human teams to process. Organizations implementing AI have documented a 40% to 90% higher precision in fraud detection and a substantial 30% to 50% decrease in "leakage"—the difference between the amount paid and the amount truly owed. - Improved Customer Experience

Faster claims resolution, enhanced transparency through digital portals, and personalized communication that all facilitated by AI, translate directly to higher customer satisfaction. This non-financial ROI is vital, with some international companies reporting a 65% reduction in customer complaints after successful AI integration.

The Predictive and Proactive Insurance Company

While fraud detection and AI claims processing offer significant immediate value, the ultimate power of AI in insurance lies in its ability to move the insurance business from a reactive claims processor to a predictive risk manager. This is a strategic evolution that fundamentally transforms the insurance company digital transformation journey and the relationship with its customers.

AI-powered predictive analytics analyzes vast data from various sources that includes IoT devices, geospatial data, and historical weather patterns. This provides a more accurate and nuanced risk assessment than traditional static models. Insurance companies can use these dynamic risk profiles to fine-tune premiums, offer highly personalized products, and, crucially, adopt a proactive stance.

By analyzing weather patterns or local infrastructure risks, for example, AI can provide a "shield" by advising policyholders on preventative measures before a catastrophic event occurs. This deepens the trusting relationship with the customer. This crucial shift, from passive "payout" processor to active "protection" partner is the inevitable future of insurance in Indonesia.

Strategic Partnership for Transformation

The journey to becoming an AI-native insurance company requires a strategic partner with deep domain expertise and a proven track record. The challenges of complex data integration, managing entrenched legacy systems, and ensuring ethical, compliant implementation demand a specialist who understands the unique language, regulatory, and cultural nuances of the Indonesian market.

This is where a specialist partner becomes invaluable. commsult, a dedicated AI specialist, is uniquely positioned to guide insurance companies through this profound and necessary transformation. We provide leading Commsult AI solutions and the expertise required to build AI claim systems and effectively integrate AI in insurance. We offer end-to-end solutions and advocate for a "human in the loop" methodology, ensuring that AI is implemented responsibly, ethically, and profitably. Partner with us to achieve significant gains in operational efficiency, profitability, and to build the lasting trust essential for long-term success. The time to act is now.

Start Your AI-powered Insurance Transformation with commmsult

_11zon.jpg)